Connected Fitness: Analog Costs to Digital Dividends?

Favorable cost structures do not always guarantee commercial success

If headlines were destiny, then the fitness industry would soon live in the cloud.

News alerts read as obituaries for traditional gyms. Gold’s and 24 Hour Fitness have filed for bankruptcy while New York Sports Club stares into the Chapter 11 abyss. On the other hand, Peloton bikes have joined toilet paper as shelter-in-place essentials.

Fortunately, these headlines merely serve as snapshots in time.

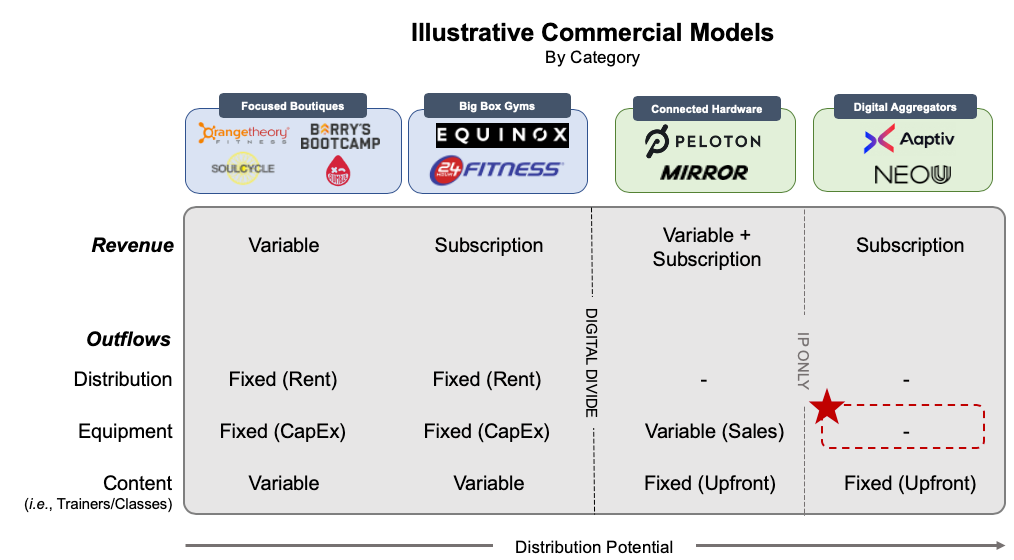

Although brick-and-mortar providers have struggled under the weight of their high cost structures, these providers remain operationally sound. These last few months, then, have simply revealed how digital enablement has expanded the number of viable commercial models within the industry. And while emergent, digitally-enabled providers enjoy structural cost advantages vis-à-vis brick and mortar, these advantages do not always translate analog costs into digital dividends.

Brick and Mortar: The Traditional Model

Until the mid-2000s, box gyms defined brick-and-mortar fitness. In recent decades, however, boutique studios revolutionized the industry. These boutiques, with their smaller footprints and hyper-focused class formats, offered consumers more intimate experiences than those found on directionless, big box floors. Consumers responded favorably, leading to a proliferation of formats across all niches: pilates, spin, boxing, and more.

For industry providers, these changes were largely cosmetic. Though experientially different, these innovative formats did not fundamentally change the industry’s cost structure. Providers still needed to secure and maintain facilities, purchase fleets of exercise equipment, and hire trainers to run participatory sessions. The key differences for providers? Lease terms and equipment purchases.

This staid model endured until digital changed everything.

Unlocking Digital Dividends

Digital enablement decoupled participatory fitness from physical space.

Today, technology enables consumers to participate in new, instructor-led content from anywhere. This decoupling gave rise to new industry categories with better unit economics and without the financial encumbrances—leases, equipment fleets, and salaries—inherent to traditional brick-and-mortar fitness.

Emergent category leaders such as Peloton and Aaptiv realize these cost advantages across multiple line items:

Distribution. Digitization frees content—classes and fitness experiences—from the four-wall environment. As such, digitally-enabled providers can effectively zero-out rental expenses. The connected hardware segment achieves this outcome by pushing overhead expenses to their at-home customers; digital aggregators, whose offerings do not require dedicated physical space, eliminate these costs altogether.

Equipment. Without dedicated spaces, digital providers do not need to maintain equipment fleets. As a result, these providers enjoy lower capital expenditures, less fixed depreciation, and smaller balance sheets than their brick-and-mortar counterparts. Connected hardware providers will still incur some equipment-related expenses, but these expenses will reflect sales, not ownership. This operational change means that equipment serves as a profitability driver for the connected hardware segment, not just depreciable assets. In contrast, digital aggregators, by trafficking in intangibles, avoid all equipment-related expenses.

Content. Digital providers can scale content (i.e., session) costs and achieve better unit economics than their location-based peers. Because location-based providers must pay instructors for every in-person session delivered, content costs do not scale with consumption. In contrast, digitization enables connected providers to scale upfront content production across their entire install bases at zero marginal cost. This negligible marginal cost means that, all else equal, digital providers can spend orders of magnitude less per session to meet comparable demand.

In sum, digital connectivity unlocks a radically different financial model for the fitness industry. This newly viable model leads to asset-light companies with more flexible cost structures and better unit economics than their brick-and-mortar counterparts.

But do these cost advantages translate into higher profits?

Capturing Digital Dividends

The advantages conferred by digital, though numerous, do not preordain commercial success. Market competition and strategic positioning also influence whether digital businesses can capture the incremental value afforded by their favorable cost structures. The profiles of the connected hardware and aggregator segments highlight how these ancillary factors can enhance or diminish profitability.

Connected Hardware

The connected hardware segment has proven its ability to directly and indirectly translate digital’s cost advantages into sustainable, incremental profits.

For connected hardware providers, hardware installation growth can directly drive incremental profitability and better unit economics. We have already discussed how this model can improve the economics of content development. It is worth noting, however, that this scalable relationship holds for all fixed costs, ranging from corporate overhead to internal research and development. Thus, each additional installation can drive both incremental profitability and margin expansion.

Large install bases also serve as strategic assets that indirectly enhance segment profitability. These install bases indirectly drive profitability by reducing intra-segment competition amongst incumbents. After all, customers—upon converting—typically remain anchored within their connected hardware ecosystem. This anchoring occurs because owners face a strong financial disincentive to churn; switching costs, the cost differential between new connected hardware and the subscription fee from their current provider, can exceed thousands of dollars. As a result, converted customers will exhibit relatively low churn. (In fact, market leader Peloton boasts a monthly net churn of less than 1%.) This lower churn ultimately increases customers’ lifetime values, which delivers yet more profits to their hardware providers.

Taken together, these financial and strategic advantages render the connected hardware segment uniquely capable of realizing digital fitness’ profit potential.

Digital Aggregators

Digital aggregators have struggled to drive profitability commensurate with their lower cost bases.

In theory, we would expect digital aggregators to outperform all other fitness categories. Freed from physical constraints and the need for a readily-available install base, individual aggregators can theoretically scale costs across the entire addressable market. Yet, market structure and strategic positioning explain why these digital advantages have not translated into outsized profitability.

Intense competition, generated by market fragmentation, has curtailed profitability within the digital aggregator segment. Potentially high margins and relatively low barriers to entry—just limited development costs—create hospitable conditions for new market entrants. These favorable conditions have led to a multiplicity of offerings, ranging from Aaptiv on one end to celebrity apps on the other, that all compete for customers’ attention and dollars. And the elephant in the room? Free fitness content delivered by scaled social platforms. This direct and indirect competition has pressured pricing and, ergo, reduced segment profits.

On the consumer side, these relatively lower prices have accelerated churn. Because assets such as hardware do not anchor consumers to aggregators, consumers can switch providers for thousands less than they could in the connected hardware market; all else equal, these lower switching costs should engender relatively greater churn. Further, because most aggregator offerings bill on monthly or annual subscription bases, switching costs may become negligible during renewal periods, when customers remain uncommitted and find themselves choosing between a renewal or an alternative.

In combination, market competition and weak retention prevent digital aggregators from exploiting their structural cost advantages. And as long as this segment remains competitive—with significant fragmentation, low barriers to entry, and high customer churn—incumbents will struggle to capture outsized profits.

The Way Forward

To succeed in the long-run, fitness providers must combine digital’s cost advantages with strategies that limit intra-segment competition. By taking this combined approach, providers can capture the outsized economic returns made possible by lower cost structures and more resilient revenue.

Fortunately, we see providers across the entire fitness spectrum applying these lessons:

Focused Boutiques: Barry’s Bootcamp recently launched Barry’s At-Home, a live digital offering that extends classes beyond the studio’s four-walls. One format even requires proprietary equipment (elastic bands), which resembles a pseudo-integrated offering.

Big Box Gyms: Equinox launched Variis, a digital offering that bundles the company’s fitness brands. This offering spans two fitness categories, depending on the consumer. For those with a SoulCycle bike, Variis connects them to class content; for those who do not, the service serves as yet another digital aggregator.

Connected Hardware: During the shelter-in-place period, Peloton made its app temporarily free to non-hardware owners. By taking this step, the company extended its reach into the digital aggregator market. The strategic question: is this temporary top-of-the-funnel marketing, or a sustained market commitment?

Digital Aggregators: Aggregators, with limited ways to improve their cost structures, use pricing to counteract the impact of high churn. For example, Aaptiv offers steep discounts on longer subscription commitments. The goal? Maximize monetization at the point of sale, when churn risk is lowest.

During the next few months, we will see if these digital investments lead to digital dividends. If so, then digital will continue to upend fitness into the next decade.