The fitness industry’s eyes turned towards Cupertino last week, when Apple announced Fitness+, the company’s foray into digital fitness. No company scrutinized the announcement more closely than Peloton, whose shares briefly dropped on the news. Yet, as the details emerged, Peloton’s shares rebounded, the company welcomed its new competition, and—according to the press—most incumbents shrugged off the news.

One wonders, is the market’s assessment correct?

The Big Picture

Though tempted, investors should not view Fitness+ as Apple’s commitment to fitness per se. Were it truly motivated to consolidate the market, Apple would immediately make Fitness+ available to all users via an iOS software update. The company has implemented this playbook before, specifically when introducing vertical-centric offerings such as Apple News and TV, both of which landed on all iOS devices (i.e., iPhone or iPad) without any active involvement from users.

Yet, for its new fitness offering, Apple scrapped its traditional go-to-market playbook. Instead, the company will make Fitness+ available only to Apple Watch owners. By imposing this additional hardware requirement—and forgoing widespread early adoption—Apple hints at the company’s overarching strategic objectives. In short, Fitness+ creates new opportunities for Apple to sell more devices and facilitate greater ecosystem lock-in. When viewed through this strategic lens, Fitness+ plays a role comparable to that of other iOS-native applications. Like iMessage, Apple Music, and Apple News, Fitness+ generates incremental ecosystem value that, if sufficient in aggregate, can unlock additional hardware sales.

Given this value proposition, Fitness+ offers Apple the opportunity to better compete for the marginal iOS customer. For example, the service might deliver sufficient value to finally convert certain non-iOS customers to the Apple hardware ecosystem. And amongst existing iOS users, it might finally tip the balance in favor of an Apple Watch purchase, either as a first-time wearable or a replacement for a platform agnostic alternative such as Fitbit. On the margin, then, Fitness+ improves Apple’s ability to sell more iOS devices to more customers.

Fitness+: A Competitive Analysis

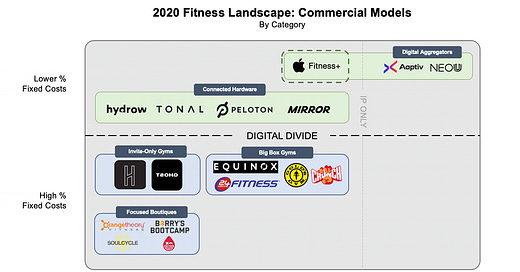

For Apple, Fitness+ serves as a means to specific hardware ends. For fitness industry incumbents, however, Fitness+ represents a new competitive threat. By evaluating Fitness+ as a distinct product offering, we can better understand the service’s competitive positioning, go-to-market strategy, and downstream impact on digitally-enabled fitness categories. An extended discussion of these points follows, with key takeaways summarized in the bullets below.

Key takeaways:

Though it enjoys all the trappings of a connected hardware company, Apple Fitness+ will compete in-market as a digital aggregator

With Apple’s backing, Fitness+ is best positioned to consolidate the digital aggregator category, subject to its market constraints (i.e., Apple Watch owners)

Apple Fitness+ will improve the baseline user experience across all exercise equipment. This market-wide improvement will indirectly pressure incumbents operating within the connected hardware category

Looks Are Deceiving

At first glance, Apple Fitness+ checks all the boxes that characterize the connected hardware category. As noted, the service will require multiple Apple devices, enjoy a robust content library, and feature real-time performance metrics. Were Apple comparable to category incumbents, we would expect the company to enjoy a complementary relationship between its hardware and content offerings.

These complementarities define the operating models of providers such as Peloton and Mirror. For example, Peloton’s library of cycling content responds to the bike’s form factor, enhances the overall riding experience, and supports incremental hardware utilization and customer retention. Without complementary content, Peloton’s overall value proposition would erode considerably. When we apply this category-defining criterion to Apple, its Fitness+ offering comes up short.

Apple Fitness+ lacks the ongoing, complementary relationship between content and hardware. While Fitness+ may factor into a user’s initial decision to purchase an Apple Watch, the service itself should have a limited—if negligible—impact on its day-to-day utilization. As a multi-purpose wearable, the Watch should enjoy intraday utilization rates of ~100% when worn, even on days when users do not consume Fitness+ content. This relatively uncorrelated utilization suggests that Apple’s hardware and content offerings do not operate according to the strategic logic underpinning the connected hardware category. As such, we should not classify Apple Fitness+ alongside providers such as Peloton and Mirror, but rather with the industry’s digital aggregators.

Watch Out, Aggregators

Despite its hardware requirements, Fitness+ will compete in-market as a digital aggregator. Upon completing their free trials, Fitness+ users will need to determine whether to convert to a paid subscription. Because these users already own Watches, hardware should not factor into this decision-making process. On the margin, then, users will need to make a judgment on Fitness+’s standalone value proposition.

The scope of this decision situates Apple’s offering alongside digital aggregators such as Aaptiv and NEOU, which must also convert customers solely on the basis of their content offerings. These narrow terms of competition—and the market’s significant upside potential—contribute to the category’s intense rivalry, which is exacerbated by limited barriers to entry; minimal switching costs; and elevated levels of customer churn. And while its competitors can pursue commercial success through scale, Fitness+ will have its total addressable market constrained by Apple’s hardware requirements.

Despite this limitation, Fitness+ is best positioned to become the default fitness application for Apple Watch users. As an iOS-native application, Fitness+ will benefit enormously from the in-kind contributions and financial resources of its parent company. In a previous post, I outlined two competitive advantages that an Apple-backed fitness offering could theoretically enjoy:

Power of Defaults: Apple’s control over the iOS ecosystem means that its fitness offering can quickly gain distribution on millions of devices. Unlike competitors such as Peloton or ClassPass, which must spend millions to get customers to install their applications, Apple can simply include its new offering in a regular software update.

Capital Advantages: Given its size, Apple only needs to spend nominal dollars—in relative terms—to effectively compete against other digital fitness services. This nominal spend, which translates to an absolute financial advantage, means that Apple can effectively outspend standalone digital offerings pursuing either rollup or scale strategies.

In its announcement, Apple spoke to both advantages. First, Fitness+ will live within the Fitness application, an application pre-installed on all Apple Watches and tethered iOS devices. Secondly, Apple will fund an initial content slate and ongoing productions to keep its workout library deep and current, respectively. Each effort provides a competitive tailwind that will help Apple compete.

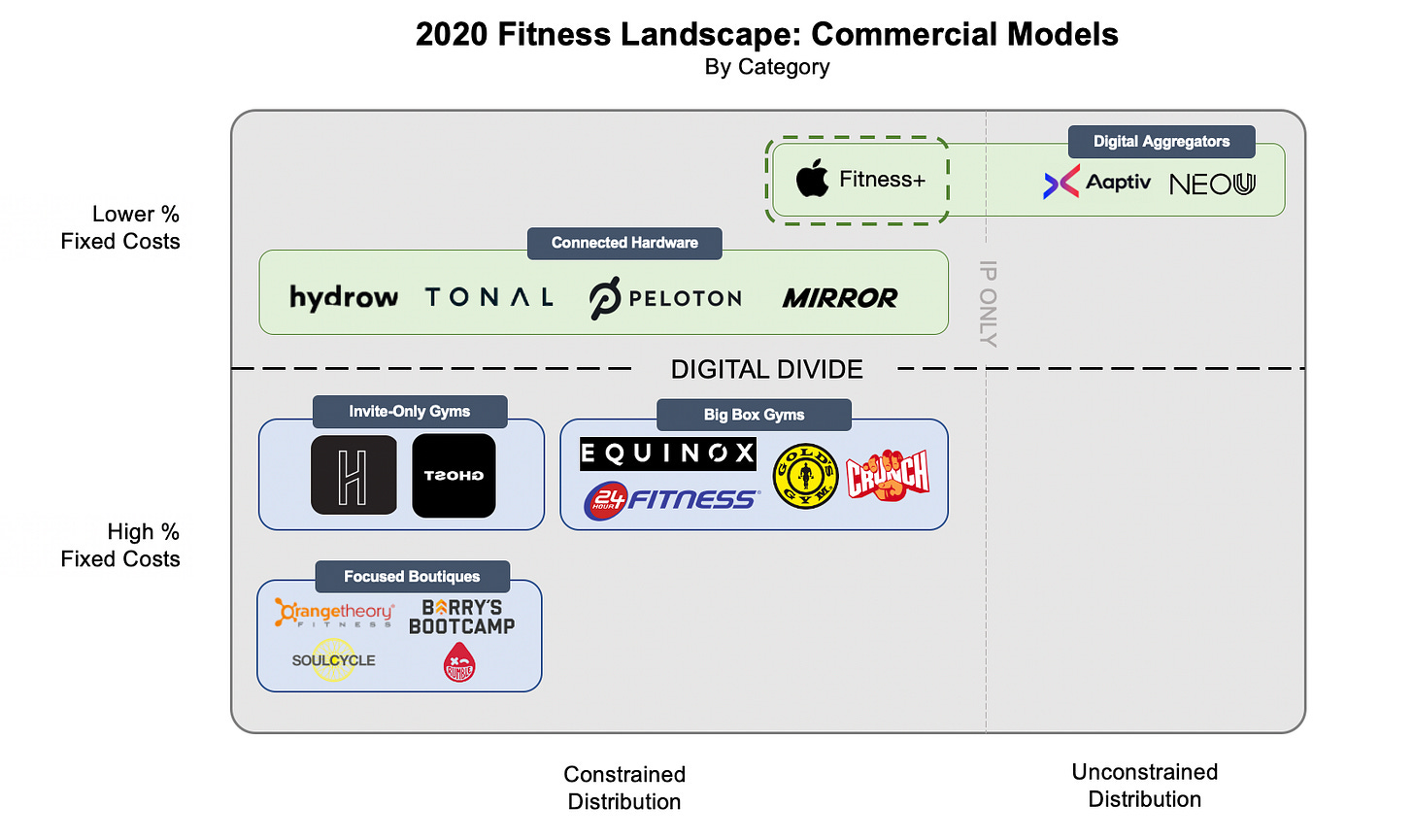

Upon these two advantages, Apple will layer on a third: bundle economics. During last week’s announcement, Apple previewed a new services bundle, Apple One, which includes multiple Apple offerings, including Fitness+. When appropriately priced, bundles offer consumers the ability to purchase a portfolio of products at a price less than the all-in cost of those same products, if purchased individually.

For example, as long as they value the collection of Apple One (Premier) services at more than ~$30/month, Apple customers will have a financial incentive to purchase this bundle. By offering these incentives, Apple One can drive incremental sign-ups to Fitness+, even among those who would otherwise not subscribe at the service’s full list price. Apple’s ability to convert these marginal customers confers yet another advantage on Fitness+, which can effectively compete on terms that its competitors cannot.

With Apple’s backing, Fitness+ should begin to slowly consolidate its addressable market. Because Apple offers in-kind and financial advantages that virtually no other digital aggregator can match, we should expect the company to easily take share from existing incumbents and—perhaps more significantly—deter new market entrants. And as it consolidates the digital aggregator category, Apple will increasingly find itself in a position to indirectly influence the adjacent, connected hardware category.

Fitness+: Low-End Disruptor?

As its subscriber base grows, Apple Fitness+ will place greater competitive pressures on the connected hardware category. Fitness+ offers subscribers a way to seamlessly improve the baseline user experience across all exercise equipment. In lieu of undifferentiated manufacturers’ low resolution video screens and imprecise, built-in heart rate monitors, Fitness+ offers high-definition content and the Watch’s sophisticated performance tracking. In short, the service effectively frees subscribers from OEMs’ default—and often wanting—features.

When viewed as a technical solution, Fitness+ acts as a portable software layer that users can take from one piece of equipment to another. Apple hinted at this benefit in its Fitness+ press release, writing that:

Customers can use any brand of equipment with Fitness+, and many workouts can be done with no equipment at all or just a set of dumbbells. For those who start a Treadmill session with Fitness+ on Apple GymKit-enabled machines, the workout will prompt customers to tap to connect their Apple Watch so metrics are in sync.

From a competitive standpoint, Fitness+ minimizes the user experience gap between premium connected hardware providers such as Peloton and Hydrow and mass market equipment manufacturers such as Life Fitness. When this user experience gap shrinks, the attractiveness of cheaper substitutes increases while the strategic positioning of premium incumbents weakens. Fitness+ thus represents an emerging—and potentially existential—threat to connected hardware’s value proposition.

By giving customers a “good enough” experience with undifferentiated hardware, Fitness+ could offer them an altogether cheaper alternative to premium providers. Said differently, Apple’s offering could become an inter-category disruptor, one that challenges connected hardware from the low end and which also blurs the competitive lines between digitally-enabled fitness categories. Such an outcome would enable Apple to indirectly compete with market leaders such as Peloton and Mirror without investing incremental dollars in new product development or corporate acquisitions. More importantly, this indirect competition would not require Apple to shift its focus away from its overarching objective: growing and increasing customer loyalty to the iOS ecosystem.

(One need not wonder anymore. The market is underestimating Apple Fitness+.)

Sharp analysis Matthew! Other large(r) platform companies such as Google & Samsung will no doubt have similar fitness offerings as they continue to make investments in wearables. The "digital aggregator" segment is rapidly becoming commoditized through low cost of entry and being accelerated by the pandemic. Name one fitness brand that isn't creating an app based digital experience tied to a subscription.