FitPros: Industry Threat or Opportunity?

Fitness has become a talent-driven industry. What are the implications for operators?

Not since the 1980s, when Jane Fonda stormed America’s living rooms, has fitness talent been so accessible to so many. Robin Arzón and Alex Toussaint have become shorthand for personal training styles, and Kayla Itsines is now synonymous with a revolution in women’s fitness. Talent’s growing profile has coincided with the fitness industry’s decades-long evolution, one that has opened new industry categories and changed the strategic incentives around talent differentiation for both individuals and operators.

Introduction: A Talent Framework

Whereas box gyms dominated the fitness landscape in the 1980s and 1990s, newer categories such as boutique studios and connected hardware have since become the industry’s growth drivers. And unlike their box gym predecessors, these emergent categories rely more heavily on talent to execute their go-to-market strategies and drive financial performance. This greater industry reliance requires that operators understand talent’s strategic value-add, both within their own businesses and across competing categories.

To facilitate this understanding, we can apply the customer lifetime value (“CLTV”) framework to quickly pinpoint and compare talent’s strategic contributions across industry categories. As consumer-facing businesses, fitness operators generate value primarily through their customer relationships. These relationships serve as conduits through which go-to-market strategies, such as monthly gym memberships or one-off class purchases, translate into commercial value. Given its simple accounting of commercial value—the difference between revenue generated by and cost to acquire a customer—CLTV acts as a suitable value framework for understanding the industry and talent’s role therein.

When applied across industry categories, the CLTV framework reveals how operators marshal upstream talent to execute go-to-market strategies. As expected, talent’s strategic role differs based on industry category and providers’ unique value proposition to customers. What follows is an in-depth overview of talent’s value-add, and the strategic implications for operators, across four key categories.

Application: Fitness Operators and Talent

I. Box Gyms

Talent & CLTV: Gym operators increase customer lifetime value primarily through ancillary revenue sources, not standard membership agreements. Upon joining a gym, consumers typically sign long-term commitments ranging from 12 to 24 months. With pricing, billing frequency, and retention periods fixed, gyms have a limited ability to capture incremental value through these codified agreements. Given these contractual limitations, how do gyms grow average customer value? In a word, trainers.

Within the box gym category, trainers serve primarily as up-selling vehicles. Training revenue almost always supplements—and rarely supplants—recurring membership fees. When sold, training packages deliver incremental customer revenue at minimal out-of-pocket expense. This training revenue can be understood as mostly value accretive for two reasons. First, trainer compensation often follows a variable model, with expenses paid out directly from session revenues. And secondly, gyms often restrict training services to existing members. As such, trainers offer gyms asymmetric financial upside across their membership bases; they empower operators to grow average revenue per member during each billing cycle in a relatively cost-efficient way.

Operator Considerations: Gyms incur incremental strategic risk to unlock trainer-driven revenue. Delivering training services requires that gyms directly connect members with fitness professionals. Upon facilitating these introductions, operators effectively cede some control over the customer relationship to their employees. Ceding this control introduces disintermediation risk, whereby a member’s primary loyalty shifts from operator to trainer. This disintermediation risk is greatest amongst top trainers, who can successfully differentiate their services and quickly build rapport with clients. Such trainers have a greater ability to cultivate competing loyalties amongst their clients and extend these relationships beyond the gym’s four-wall environment.

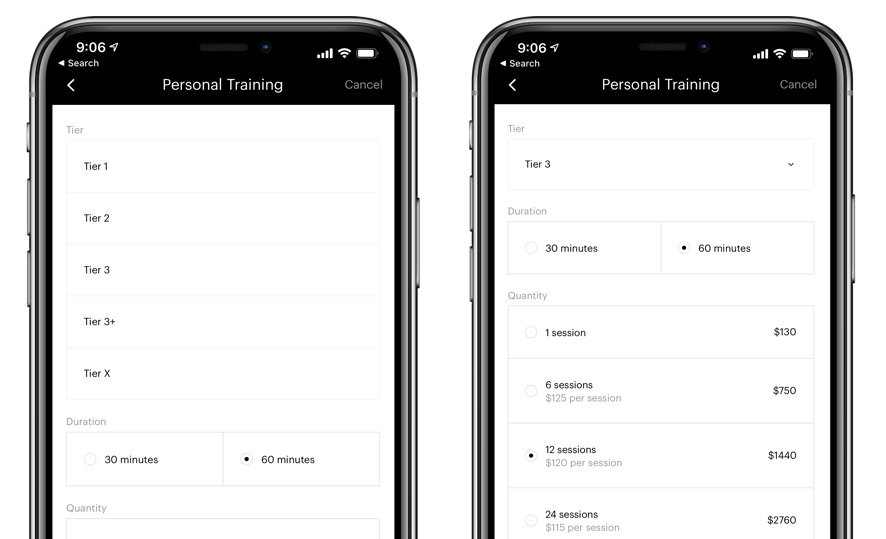

To minimize disintermediation risk, gym operators often seek to commoditize trainer-centric services. By standardizing training formats and packages, operators can dictate—and effectively limit—the dimensions across which talent differentiation occurs. For example, when purchasing training packages via Equinox’s mobile application, members choose from a fixed menu of training modalities, session durations, and instructor tiers. At no point during the digital checkout flow do members have the ability to explore differences between, or even choose amongst, specific trainers. Instead, all options have been pre-set and pre-defined by Equinox. As a result, trainers become merely algorithmic outputs; they become undifferentiated, interchangeable products.

These efforts deliver a second-order benefit by sorting the talent market to operators’ strategic advantage. Like all workers, trainers seek out environments that reward their talents and avoid those that do not. In practice, this means that top trainers—who can independently build robust client lists through personal differentiation—avoid gyms such as Equinox where commoditization is the norm. In contrast, those less capable of building distinct personal brands and, ergo, introducing disintermediation risk to their employers, have fewer qualms about having their services intermediated. When talent sorts according to these preferences, total category risk decreases. Thus, efforts to commoditize talent can ensure that gym operators capture the financial upside of offering trainer-centric services while minimizing strategic downside.

II. Boutique Studios

Talent & CLTV: The per-class model inherent to boutique fitness ties revenue directly to discrete class purchases, which means that studios must continually convert customers to drive top line performance. Because studios induce many first-time customers with discounted pricing, average customer value actually decreases as the share of first-time conversions increases. Only when customers transition from first-time to repeat customers—and at full list price—do they actively begin contributing to improvements in average lifetime value. Given this financial reality, operators must find success in cultivating new, repeat customers in order to sustainably grow commercial value.

To improve the probability of repeat visits, boutiques must ensure that the perceived value of the in-class experience justifies its full list price. As curators of the in-class experience, instructors have a disproportionate impact on relative value perceptions. Instructors who facilitate memorable customer experiences—with energizing playlists, effective cues, and engaging personalities—have a greater ability to increase the value ascribed to individual studio classes. If sufficiently increased, perceived value can justify—or lead to—future class sign-ups. Thus, capable instructors drive commercial performance by effectively increasing the expected number of conversions, or billings, per customer.

Operator Considerations: Although talent plays a critical role in driving incremental customer conversions, most studios avoid cultivating instructors’ individual brands. This counterintuitive approach highlights the tension between service providers’ financial and strategic interests. Financially, studios have clear incentives to promote their top-performing talent. These instructors fill studios, drive top line revenue, and reduce first-time marketing expenses. Yet, studios must balance this financial upside against the strategic risk of concentrating too much revenue—too much customer loyalty—within a single instructor. Star instructors often go independent, which can undermine a studio’s health by diminishing the perceived in-class experience and, in the worst case scenario, facilitating customer churn.

To manage this commercial tension, studios often standardize class formats to minimize variability across instructors. For example, Barry’s offers customers a predictable format and curriculum, regardless of who is teaching the class. The goal of standardization is to establish an experiential baseline that—independent of instructor—delivers sufficient value to justify future purchases. If successful, this baseline minimizes the number of incremental conversions that depend on any specific trainer. And, in the best case scenario, instructor churn would not place future revenue at risk. Format standardization thus helps studios more successfully navigate the tension between their financial and strategic interests.

III. Connected Hardware

Talent & CLTV: Connected hardware providers generate commercial value through hardware sales and digital subscriptions. As one-time purchases, hardware sales—though they deliver the greatest strategic value—do not meaningfully contribute to customer lifetime value growth. In contrast, providers’ digital services generate recurring revenue that, over time, can lead to increases in customer lifetime value calculations. As such, providers have a financial incentive to scale adoption of these digital services across their install bases.

Scaling, or growing, total subscriptions is a function of both adoption and retention behaviors. In theory, connected hardware providers have a greater ability to influence adoption than retention. Because they usually bundle their digital offerings with hardware purchases, operators can almost guarantee universal adoption of their digital services at points of sale. Alternatively, retention decisions hinge on whether these services—specifically, these content libraries—keep customers sufficiently engaged with their hardware.

Given its central role in the content development process, talent effectively serves as a retention vehicle within the connected hardware category. Companies such as Peloton rely almost exclusively on trainer-generated content to fill their digital libraries. Trainers star in the content that they create; they lead studio workouts that get produced, packaged, and pushed to subscribers on an ongoing basis. Given this model, trainers become inseparable—indistinguishable—from the content itself.

Peloton makes trainers’ retention-oriented role explicit, writing in its regulatory filings:

We rely on access to our production studios and the creativity of our fitness instructors to generate our class content. [...] If we fail to produce and provide our Members with interesting and attractive content led by instructors who they can relate to, then our business, financial condition, and operating results may be adversely affected.

Thus, we should expect retention rates to correlate with the value that customers ascribe to providers’ talent rosters and, ergo, content catalogs.

Operator Considerations: Unlike those in competing categories, connected hardware providers have a strategic incentive to cultivate talent’s individual brands. Brand cultivation enables operators to better service a range of consumer preferences through a single digital offering. When differentiated, individual likenesses serve the same role as content genres in entertainment; they help users more quickly segment, navigate, and identify training content that best aligns with their preferred training style. These heuristics accelerate trainer-user matchmaking and reinforce the perceived breadth and value of providers’ digital libraries. Collectively, these outcomes contribute to improved user experiences and longer customer retention periods.

These strategic benefits also explain why providers such as Peloton leverage their primary branding channels, such as social, to promote individual instructors. Talent promotions create opportunities for subscribers to discover instructors whom “[they] can relate to” (Peloton, S-1) and to try new workouts from those with whom they most identify. More importantly, these promotions continually reinforce the idea—to both current and prospective customers—that current talent rosters can meet all training preferences. Fulfilling this promise, and capturing downstream customer value, requires that connected hardware providers actively invest in this talent.

IV. Digital Aggregators

Talent and CLTV: Competition amongst digital aggregators places downward pressure on customer lifetime values. Unlike their connected hardware peers, digital aggregators must compete for—and ultimately convert—customers only on the relative value delivered by their digital offerings. Industry structure contributes to relatively more intense competition amongst aggregators than that across other categories. This greater competition limits pricing power and contributes to elevated levels of customer churn. Taken together, these category headwinds prevent most aggregators from capturing incremental customer value through revenue drivers; instead, operators must often rely on cost containment alone.

For these aggregators, well-known talent can reduce all-in customer acquisition costs. By definition, digital aggregators seek to consolidate, or bundle, content from multiple talent sources. Often, aggregators will partner with well-known talent to leverage their digital influence—particularly across social channels—to more efficiently shepherd customers through the conversion funnel.

Using free social platforms, talent can natively steer audiences to specific aggregators that host their content or leverage their brands. When successful, these free promotions can deliver incremental customers at negligible cost, helping to average down costs per acquisition and, collectively, all-in customer acquisition costs. Aggregators benefit from these cost reductions in two ways: a commensurate increase in average customer value or newfound profitability amongst otherwise unprofitable customers.

Operator Considerations: Though well-known talent can drive incremental customer profitability, aggregators have neither a financial nor a strategic incentive to build up talent’s individual brands. Financially, brand investments and talent-driven cost savings have a zero-sum economic relationship. Digital aggregators capture virtually all of talent’s incremental value-add upfront, before customers begin generating revenue. Given this sequencing, aggregators should be reluctant to invest incremental dollars in promoting affiliated talent’s brands. After all, any incremental dollar spent on brand building reduces, on a dollar-for-dollar basis, already-realized cost savings.

And strategically, aggregators have an incentive to shift customer loyalty away from specific talent towards their larger content portfolios. By redirecting customer loyalty to their wider portfolios, aggregators reduce the likelihood of talent-driven customer churn and improve their competitive position vis-á-vis other, more talent-centric aggregators. This strategic interest explains why aggregators such as NEOU, which relies on brand-name talent to fill its content library, organizes its content first by concept and not by trainer. The concept-first approach introduces incremental friction between customers and specific talent, which can lead customers to explore—and ultimately appreciate—the company’s wider offering. Were NEOU to prominently feature or promote certain talent, serendipitous platform discovery would occur with less frequency and the company would have more difficulty extracting value from its platform.

Conclusion

As shown, the fitness industry’s evolution has led to more nuanced relationships between talent and operators. Value accretion no longer occurs solely at talent’s expense, as was the case decades ago. Instead, the customer lifetime value framework shows us that talent offers operators multiple avenues to improve customer profitability and drive overall financial performance. Generating, and capturing this incremental value, though, ultimately requires that operators understand how to best navigate the risks and opportunities inherent to this upstream stakeholder group.